workers' compensation programs, rehabilitation supports and welfare improvements.

Welfare Service

Purpose

- The purpose of this program is to stably secure a basic level of living to a worker who has retired from a workplace idue to bankruptcy or any other reason, along with his/her due wages, time-off-from-work allowances or any other retirement allowances in arrears, through disbursing a certain amount of them to him/her from the WCGF on behalf of his/her employer.

Scope of responsibilities of regional employment & labor offices under the MOEL

- Regional employment & labor offices under the MOEL shall be responsible for determining whether the employer of a project or workplace with 300 full-time workers or less has been bankrupt in a practical sense and monitoring & verifying factual relations surrounding subrogation payments on behalf of the employer (i.e. wages, time-off-from-work allowances or retirement allowances paid from the WCGF to his/her eligible worker in place of the employer).

Scope of responsibilities of the K-COMWEL

- The K-COMWEL shall be responsible for raising WCGF assessments and billings from employers, disbursing subrogation payments to eligible workers from the WCGF, exercising a right of subrogation against employers (for whom the K-COMWEL has disbursed subrogation payments to eligible workers) within the said amount of subrogation payments, recovering subrogation payments fradulently disbursed, etc.

-

Causal occasion accompanying the disbursement of subrogation payments

- It’s the very bankruptcy that triggers a causal relation leading to the mandatory disbursement of subrogation payments by the K-COMWEL to an eligible worker upon receipt of his/her claim for them. With regard to this, there are two types of bankruptcy : bankruptcy in a legal sense (awarded or acknowledged as such by a court with jurisdiction) and bankruptcy in a practical sense (awarded or acknowledged as such by the head of a regional employment & labor office with jurisdiction).※ Bankruptcy in a legal senseBankruptcy in a legal sense refers to a bankruptcy or an initiation of any rehabilitation procedure as finally ruled under the Act on Rehabilitation & Bankruptcy of Debtors.

※Bankruptcy in a practical sense (applicable to all types of workplaces with 300 full-time workers or less) A workplace whose businesses have been liquidated due to poor performance or are under the corresponding liquidation, and whose employer is incapable of, or has significant difficulty in, paying wages to workers, shall be deemed, or acknowledged, by the head of a regional employment & labor office with jurisdiction as “bankrupt in a practical sense” at the request of any worker having retired from the workplace.

Procedures of claim and disbursement for subrogation payments

-

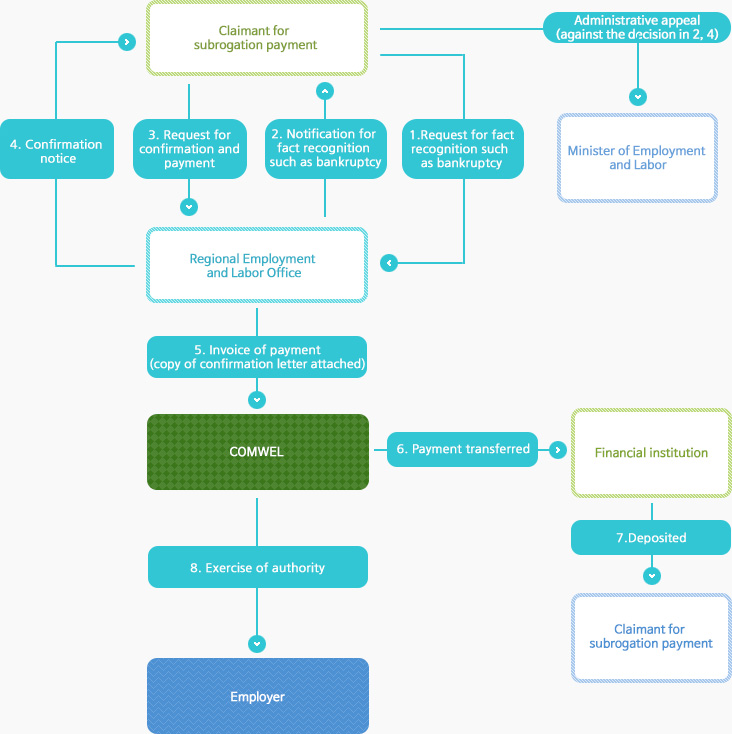

[Standard subrogation payment]

Application is submitted to a competent regional employment and labor office, in the location of a relevant business at the time of retirement, within 2 years from the date when bankruptcy was judicially decided or de facto bankruptcy was recognized.

<Process map for claiming and paying body allowances(accredited to facts such as bankruptcy)> -

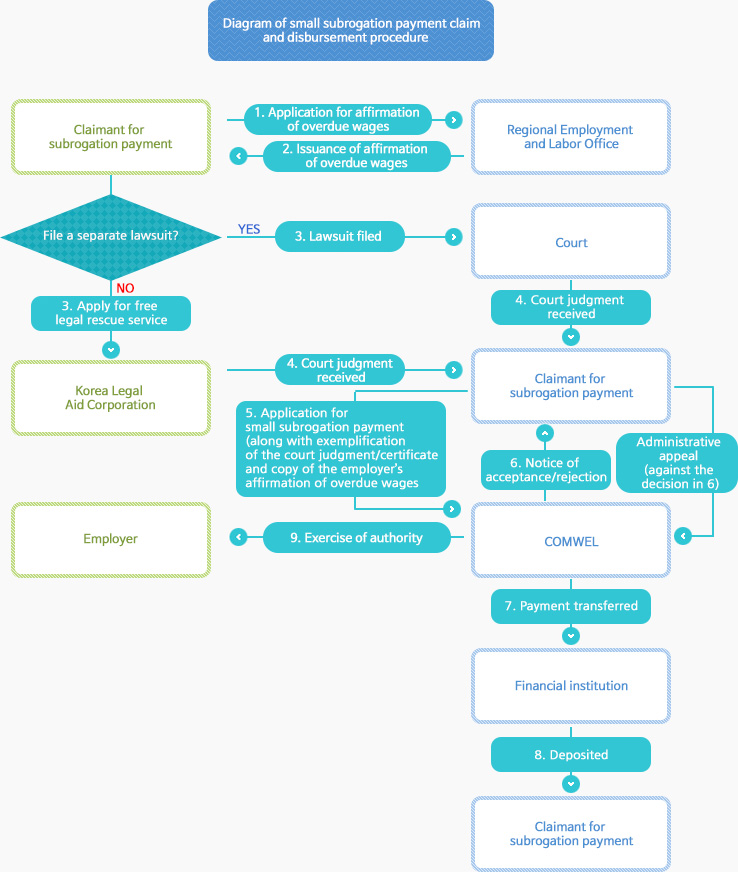

[Small subrogation payment]

Within a year from the finalization of the court judgment or an executive title

Scope of, and eligibility for, subrogation payment claim

-

[Standard subrogation payment]

A worker who has retired from a project or workplace within three years from one year (prior to his/her submission of an application for bankruptcy-in-a-legal-sense or bankruptcy-in-a-practical-sense) (as of his/her retirement day, however, the employer of the said project or workplace continued its operation for at least six months after the project or workplace has been subject to the Wage Claim Guarantee Act. -

[Small subrogation payment]

A worker who exercised his/her executive title, such as a court judgment, within two years from the date following the date of his/her retirement from a project or workplace, but the employer of the said project or workplace continued its operation for at least six months after the project or workplace has been subject to the Wage Claim Guarantee Act as of the date of his/her retirement.

Subrogation payments disbursable

-

[Standard subrogation payment]

The amount outstanding - out of the salary for the last three (3) months or business suspension allowance and retirement allowance - is paid not exceeding the upper limit determined by the Minister of Employment and Labor according to the age at which a person retired.

<Current monthly upper limit of subrogation payment> (Unit : KRW 10 thousand)<좌우스크롤 하시면 자세한 내용을 확인하실수 있습니다.

>Types of subrogation paymentsAge at the time of retirement< 30 ≧ 30,

< 40≧ 40,

< 50≧ 50,

< 60≧ 60 Wage, retirement allowance 220 310 350 330 230 Time-off-from-work allowance 154 217 245 231 161 ※Disability Grade can be divided into 14 grades based on a degree of disability. An eligible worker can elect to be paid in annuity or on a lump-sum basis.

※ Based on wage and business suspension allowance for one month, and retirement allowance for one year

※ The subrogation payment is the one smaller in amount between "unpaid wage for the last three months or outstanding business suspension payment and retirement allowance for the last three (3) years - which is covered" and "the upper limit of subrogation payment". The current upper limit of subrogation payment for a worker (assuming that he/she is aged 40 years or older, not over 50) is KRW 18 million[KRW 3 million × 6(3 months' pay + 3 years of retirement)] -

[Small subrogation payment]

The outstanding amount out of the salary or business suspension allowance for the last 3 months and the retirement allowance for the last 3 years, as long as the amount does not exceeds KRW 10 million (regardless of the worker’s age at the time of retirement)

Loan services for employers with wages in arrears (payable to workers) who are willing to pay up the same wages

-

Eligible employers: Employers with wages in arrears payable to former workers (which have been caused due to temporary business difficulties); they are the owner of a WCI-covered business with 300 workers or fewer and have operated relevant business for not less than one year.

※ Not covered are places of suspended/closed business or the owner of a business whose arrearage information is registered at the Korea Credit Information Services

-

Covered workers

- Workers who have been working over 6 months at a workplace as of the date when a loan service application is submitted

- Workers who have worked over 6 months at a workplace and retired within one year from the date when a written application for these loan services is submitted

-

Amount of loan and relevant conditions

- Amount of loan: Up to KRW 70 million per workplace, KRW 6 million per worker

- Loans and interest rates: 2.2% mortgage loan and 3.7% credit loan and joint guarantee

- Two-year level reimbursement in quarterly installations following one year of grace period Loan services for employers with wages in arrears (payable to workers) who are willing to pay up the same wages